The Google – Youtube Deal: The Ultimate Roundup

The prologue:

Some might say the so-called New Media broke this news first. First, the irrepressible Michael Arrington at Techcruch gets an email suggesting that Google might be in talks with Youtube for buying the pioneering Video site. Michael assigns ‘40% probability’ to it happening.

Why

- Search Engine Journal list out 5 Reasons Why Google Will Buy YouTube. They are:

Popularity, Not making the same mistake twice (remember, Google did not MySpace when it was on the block), Community, Usability & Stickiness and finally, Advertising and Money (the result of reasons 1,3 & 4).

- Taking the “You can either fight us or you can make money with us” line, Forrester Research's Charlene Li says that YouTube is indeed worth $1.6B. Because,

That’s 4 cents per video stream ($1.6B divided by 100 million daily views * 365 days) and it’s still growing.

- Robyn Tippins points out that In March 2006 itself; YouTube had only 30 more months worth of VC money to fund its $1.5M per month bandwidth habit. It couldn’t ask for donations ala Wikipedia. Moreover, only Google could give the outfit the freeway that it needed.

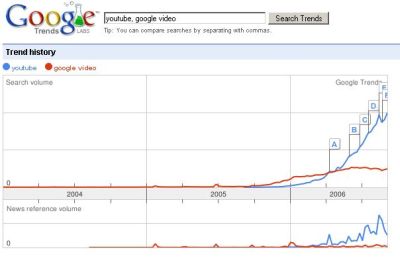

- Google Video was way behind Youtube. Check this graph out:

- Nick Douglas suggests that Google might have been feeling hopeless for Google Video.

- Google’s traditional rival duo of Microsoft and Yahoo were also fishing in the Social Media –infested waters. Just the other day, Yahoo bought Jumpcut, users found Soapbox on MSN Video, and AOL revamped its video portal in late July 2006.

The Deal

The news: Google, market value of $132 billion, bought video sharing site YouTube for $1.65 billion today. Youtube is barely 18 months old, and is run by a couple of 20-somethings.

The venerable New York Times evoked the dark memories of the DotCom Boom when Google finally bought Youtube.

A sampling of New Media valuations courtesy Zdnet:

MySpace: $15 billion latest Wall Street valuation, courtesy of RBC Capital

YouTube: $1.5 billion latest valuation, courtesy of New York Post

Facebook: $1 billion latest valuation, courtesy of Wall Street Journal

Digg: $200 million valuation, courtesy of Business Week

Grand total = $17,700,000,000.

A point here: Isn’t it ironical that the same mainstream media which faces maximum threat form new media startups hypes them the most unlike the surprisingly sober online media (as far as valuations are concerned)?

An art in quick deal making

Executives from the two companies met and the deal came together in a matter of days. The Google guys offered $1.6 billion and autonomy which the Youtube guys happily accepted.

Google buys YouTube's lawsuits?

Critics of the deal say it could cost ‘GoogTube’ that much in copyright lawsuits, but other deals today make that less likely.

Critics include Om Malik and Mark Cuban who has famously said that only a "moron" would purchase the wildly popular start-up.

Some media experts think YouTube could face the kind of lawsuits that put free music sharing out of business. They cite examples pf popular but troubled P2P sharing sites link Napster (revived now) and Grokster, which was shut down by the courts in 2005.

YouTube must satisfy big media to succeed

Already, NBC forged a deal with YouTube in July to provide some of its entertainment on the Web. Now, CBS has announced it will share content and ad revenue with YouTube. Also, Universal and Sony have announced that they'll make millions of music videos available on the site. Reuters says that big-ticket partnerships might be the key to GoogTube’s success.

Big media brands want an all access pass to this demographically alluring consumer base. YouTube serves up 100 million videos a day to viewers. It reports that nearly 70,000 videos are uploaded daily to its site, attracting some 32 million unique visitors every month.

Regarding the copyright problems, Nick Douglas says that Google's pretty adept at fighting copyright violation charges,

...thanks to its experience with caching, image search, and Google Print.

Moreover, Google has one sort or another deal with the big media companies, including Fox interactive.

How to make money from it: advertising money

YouTube executives have long said that they plan to sell sponsorships and direct advertisements. They said they would focus on building a community, and won’t bombard people with advertising.

They point out that they can turn all those views into $10 million in revenue per month by running pre-rolls [short video ads] on the videos. But the users will decide whether they want that.

The point: Don’t expect YouTube to embed commercials at the start or end of videos. That was before the big Goog came on to the scene.

At the Joint Google-YouTube conference call on Monday, Sergey Brin said he expected YouTube to becaome a great channel for advertising.

This is what may decide whether Youtube users will continue to patron the site: will they like it when Google inserted ads inside the videos as well as served up text-based ads based on a better video search function on YouTube.

Mobile Implications of the deal

Rafat Ali at Paidcontent points out three things:

1. Most of Google’s mobile efforts have been around search

2. Music videos, as well as the user-generated content which made YouTube so big, is perfect for mobile devices

3. Content deals announced by both companies just before the merger, which is mostly with music labels and is for music videos

Om Malik’s Winners and Losers from the deal:

Among the Winners - the three co-founders of You Tube, who stand to get at least $200 million each. As they own close to 50% of the company.

Losers - Google, because Om Malik thinks this deal will go south as Compaq-DEC, Skype-eBay did in the long run.

- Paul Colligan says Podcasting is also a winner.

Impressed by iTunes' success, he says:

Google certainly wasn’t buying content - 99.99% of the content was taken from someplace else Google certainly wasn’t buying technology - as they have their own Google Video system (that, actually, does more than YouTube does). They weren’t buying a profitable business to fold into the Google empire. What did they buy?Questions about the deal

They bought a new channel. They bought access to the gazillions of people who want media on their own terms - at the time and location of their choosing.

Content, on demand, is what people want and expect. It is now up to the Podcaster to develop it.

What will Youtube Users think of Google's presence?

Nothing happened to del.icio.us when it was bought by Yahoo.

The deal's coverage: Why no Michael Arrington at the conference call?

David Dalka asks 10 questions about the deal. An important questions was:

Why are the investment analysts and “major media” only allowed on the announcement conference call? Why not bloggers, why not the person, Michael Arrington, who broke the rumor and story in the first place?

Related info: Google's deals at a glance

Google Inc.'s major deals since its founding in 1998.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home